It is a very pertinent question; however, the answer is not so simple but if you read this article through you may be surprised of how much you could expect saving if you improve on the efficiency of your home.

Some studies done on this subject claim that domestic bills can be reduced by 1,700 euros per year but I claim that that the money saved can be even more if you can obtain a special loan for the reform or to purchase a high EPC rating house.

Among the formulas to save on electricity and gas bills, experts point out the importance of home energy efficiency. But what are the best systems to be more efficient? How do we go about it and how can it benefit the consumer?

We explain how

We will try in this article to show how to save up to 1,700 euros a year by improving the energy efficiency of the property. In addition, new financial products and "green" mortgages can be obtained for efficient housing are described below.

To save electricity and gas at home you can disconnect some appliances from the electrical network, use "eco" functions of the appliances and even shower in the gym to save energy at home, however, no matter how many efforts are made, they are of little use if your house is the main energy waster.

If you have been residing in the same house for a long time, you probably know the weak points: windows that do not close well, an old boiler, ceramic floors which are laid directly on a concrete raft without any insulation. These small and not so small details are what make a home an energy waster. And consequently, its users end up spending more for energy than necessary just to be within the comfort zone.

Badly insulated walls and roofs

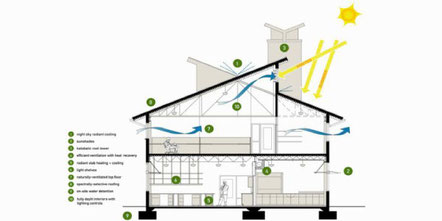

These are the percentages of energy that are lost through the different elements of a building:

- Roofs: 30%

- Facades: 25%

- Renovation of air and ventilation: 20%

- Windows and doors: 13%

- Ground floor: 7%

- Thermal bridges: 5%

These figures turned into real money means that a household with the worst possible Energy Proficiency Certificate EPC rating the letter (G) consumes almost 2,100 euros per year in energy, according to data from the Spanish Ecobservatorio. On the other hand, it is enough to have a C rating (the third best) to spend only 635 euros, that is to say, that is 1,452 euros of savings. And if we go up the EPC rating, and achieve a grade B, would be a saving of almost 1,700 euros at the end of the year and that has been scientifically proven.

Green loans for rehabs from 2% APR

Given these figures, investing in improving the energy rating of the home is worth it. And that is how not only will consumption be reduced, but it will be lived more comfortably. Despite this, it is normal that many get nervous just thinking about getting a builder in the home, not to mention the investment of the money that will be required to be invested.

Some Spanish banks are trying to make things easier (believe it or not), and are launching "green" loans. Under this name there are credits that finance from efficient reforms to electric cars.

Are these loans cheaper than conventional ones?

Without counting on those focused on green vehicles, loans to improve energy efficiency have a lower interest and fewer commissions. That is, the interest will be lower the better the EPC rating of the home. For example, if the letter of the house is low, they can apply an interest of 7% APR; while, if you can show that you will be obtaining the best possible rating, the interest is reduced to 2% APR.

Of course, when applying for this type of loans, you must provide the technical documentation that supports the current rating of the property, the budget of the reform that you want to make to improve it and the final rating which will be provided by your architect.

Green mortgages for efficient homes

Banks not only offer consumer loans to help make the home energy efficient. If you still do not own a house or your own needs a comprehensive reform, we must bear in mind that there are "green" mortgages.

In this case, the main differentiating factor is that the interest rate they apply is associated with the energy rating of the house they want to buy. Thus, you can find mortgages with a variable rate of Euribor plus 1.26% for homes rated with the letter G, while for the best note (A +) offer Euribor plus 1%. In short, betting on a more efficient property lowers the cost of the loan.

Write a comment